Accept UPI, Cards, Net Banking and Wallets via a single, secure MPurse integration.

What is Payment Aggregation?

Payment Aggregation allows businesses to accept digital payments without directly integrating with multiple banks or providers. MPurse acts as the bridge, handling merchant onboarding, routing, settlements, and compliance — all through one unified system.

Why it matters:

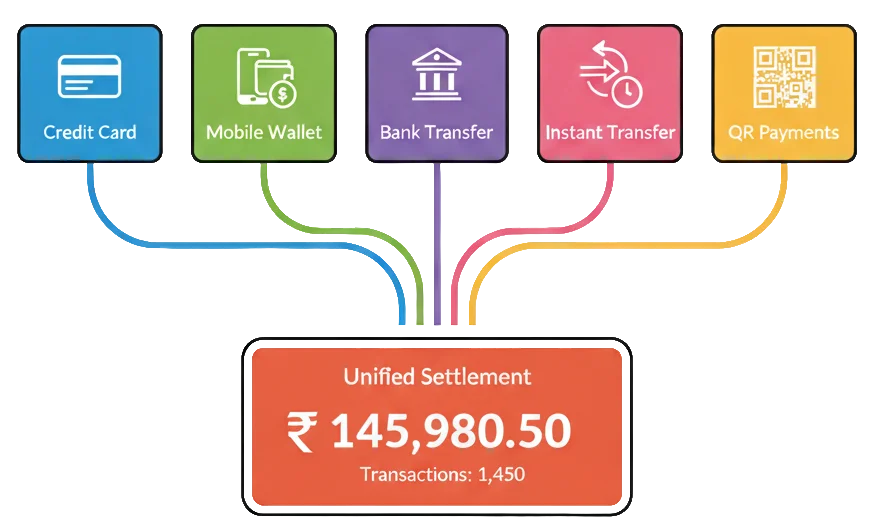

- Single integration → multiple payment modes

- Simplifies merchant onboarding & compliance

- Saves time & reduces operational complexity

Key Features

- Multi-mode acceptance → UPI, Cards, Net Banking, Wallets

- Unified settlement → One dashboard to track everything

- Smart routing → Higher success rates with intelligent bank routing

- Hassle-free onboarding → KYC & compliance managed end-to-end

- Scalable APIs → Easy integration with apps, sites & POS

Why Choose MPurse Aggregation?

- One-Stop Access – Get unified access without the hassle of dealing with multiple PSPs or banks.

- Lower Cost & Effort – Save time and money as MPurse manages compliance, settlements, and operational complexities for you.

- Quick Launch – Accelerate your go-to-market strategy with smooth onboarding and faster deployment.

- Trusted Framework – Build on RBI-compliant rails, ensuring reliability, security, and regulatory confidence.

How It Works

Step 1:

Merchant signs up & completes KYC

Step 2:

Integration via APIs or dashboard

Step 3:

Customers pay using UPI, Cards, Wallets, Net Banking

Step 4:

Merchant signs up & completes KYC

Use Cases

- E-commerce Platforms → One API to accept all modes

- Marketplaces → Manage multiple sellers & settlements in one place

- SaaS / Subscription Models → Handle recurring payments easily

- Retail Chains → Unified payments across all branches

Compliance & Security

- RBI-licensed Payment Aggregator framework

- PCI DSS certified (card transactions)

- Advanced fraud detection & chargeback management

- Secure encryption for all transactions

Aggregate All Payments Seamlessly

Unify UPI, cards, wallets & net banking with one simple integration.